Gov. Lujan Grisham authorizes expanded business loan program, tax relief for businesses

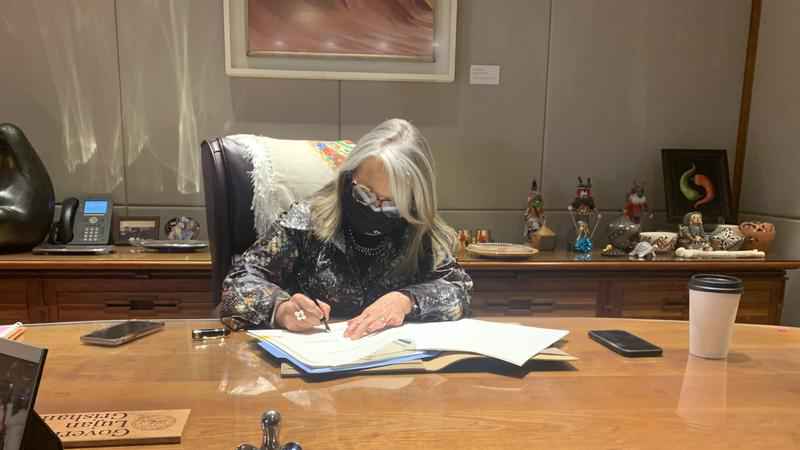

ALBUQUERQUE, N.M. — New Mexico Gov. Michelle Lujan Grisham signed a pair of economic measures Wednesday morning that will deliver additional stimulus and relief for businesses and individuals in the state.

The new measures will reportedly provide a $600 personal income tax rebate to frontline and low-wage workers, provide a four-month tax holiday for food and beverage businesses, and make up to $500 million available to small businesses seeking loans at a discounted borrowing rate.

The New Mexico Finance Authority will manage the loan fund and state officials said an announcement will be made once the application is available.

“Dollar for dollar, I would put New Mexico’s direct stimulus efforts up against any other state in the country,” Lujan Grisham said in a release. “We have provided hundreds of millions in unemployment support; small business grants, loans, tax holidays; and now direct rebates for the front-line workers who have continued to show up to support themselves and their families, and who deserve all the support that their government can provide. This pandemic has been devastating for everyone, but the pain has been spread unequally. My hope is these economic relief efforts reach those who need them most, and my commitment is New Mexico will continue to step up and support those who need it now and in the future as we build out a successful and sustainable recovery.”

Senate Bill 1

- Grants a personal income tax rebate of $600 to families and individuals claiming the Working Families Tax Credit – individuals who earn $31,200 or less; and heads of household, surviving spouses or those married filing jointly who earn up to $39,000.

- Roughly 200,000 New Mexicans claimed the Working Families Tax Credit in 2019, according to the Taxation and Revenue Department.

- Taxpayers who believe they are eligible for the Working Families Tax Credit and the new income tax rebate are urged to file their 2020 Personal Income Tax returns as early as possible.

- The state Taxation and Revenue Department urges all taxpayers to file electronically, which expedites processing and puts refunds and rebates into taxpayers’ hands more quickly.

- Senate Bill 1 also provides for a four-month gross receipts tax holiday for food and beverage establishments, including restaurants, bars, food trucks, small breweries, wineries and craft distilleries, which have been financially impacted by the pandemic.

- The Taxation and Revenue Department will soon issue instructions to businesses on how to claim this credit.

Senate Bill 3

- Allows more businesses to tap into what is now a $500 million pool of loan money at a discounted borrowing rate.

- The bill extends the Small Business Recovery Loan Fund created by the Legislature last year and makes funds available from the Severance Tax Permanent Fund.

- The new bill substantially eases eligibility standards so more businesses can connect with the financial assistance they need. Under the previous program approved by legislators in special session last year, 890 businesses received $40.5 million in loans.

- The New Mexico Finance Authority will manage the loan fund. Applications are not yet available at this time.