New Mexico governor says tax cuts could hurt schools, police

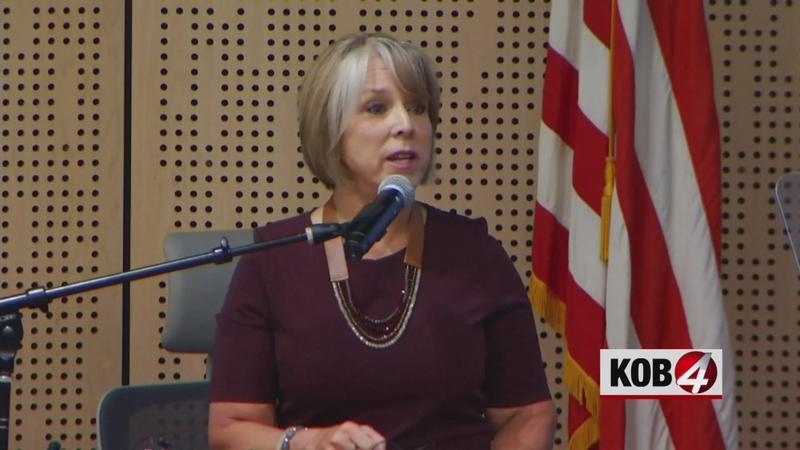

SANTA FE, N.M. (AP) — Gov. Michelle Lujan Grisham is urging legislators to reevaluate the magnitude of proposed tax changes that would forgo $1 billion in annual state government income each year.

In a statement Thursday, the second-term Democratic governor warned that proposed tax changes could undermine state spending priorities, including public education, public safety and economic development initiatives aimed at diversifying the economy.

“Let’s deliver bold, meaningful tax reform — but let’s also protect our future,” Lujan Grisham said.

The legislature has until noon Saturday to deliver bills to the governor, who can veto bills entirely or cross out individual spending provisions.

The Legislature anticipates a $3.6 billion surplus in state income for the coming fiscal year in excess of current spending obligations. Most of the surplus is linked to surging oil production in the southeast region of the state — income that can fluctuate wildly over time with shifts in global energy prices.

Tax changes recently endorsed by the state House, Senate or both chambers include $500 individual cash rebates, expanded incentives for film production in rural areas, refundable child tax credits of up to $600 per child, and a reduction in tax rates on sales and business transactions.

Legislators have endorsed limited tax increases on capital gains, alcohol sales and tobacco products.

A conference committee of six legislators met Thursday to reach a compromise on competing taxation proposals.

“It’s too big, the package we came up with,” Democratic state Senate Majority Leader Peter Wirth said.

Annual state general fund spending would increase by 14%, or nearly $1.2 billion, to $9.6 billion under a budget bill approved Wednesday by the Legislature.

The Legislature also has endorsed more than $1 billion in direct, one-time spending on infrastructure that reduces expenses associated with borrowing money to pay for construction.